Textbook Affordability and Financial Hardships

My student loan balance is over $20,000. I don’t own a home, have kids, or go on vacations. I have too much credit card debt and not enough savings. I am 37. I am one of the 44 million Americans struggling with the financial hardships of getting a college degree, delaying and even refraining from participating in the life milestones that keep the economy functioning. Since the year 2000, the economy has gone through two recessions, wages of college grads continually decreased, lowering lifetime earning potential, and college costs steadily increased – the single largest increase in higher education costs is textbook prices.

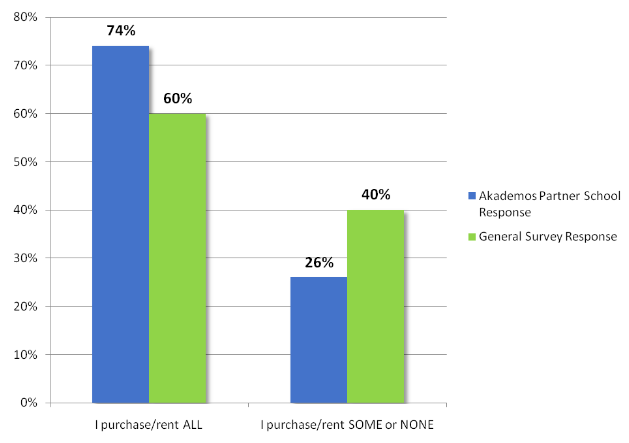

Over the past 40 years, college textbook prices have risen over one thousand percent, causing never before seen levels of financial hardship on students and their families that continue for decades after graduation. This financial stress is negatively impacting academic success, hindering course selection, major selection, and effectively limiting career choices. The most recent Akademos student survey on course material purchasing and bookstore services highlights:

- 25% of students have chosen not to register for a course or have dropped a course due to the expense of the required course materials

- Over 30% of students indicated that they only purchase or rent course materials if they are affordable, or if they believe the class would be too difficult without them

- 60% of students aren’t purchasing all of their course materials because they are too expensive

Not only are career choices being impacted, the students quality of life is significantly poor. A recent study by Morning Consult for Cengage, an educational content and technology company, found that students are having to make major life trade-offs because of these financial hardships: 30% of survey respondents said they had forgone a trip home to see family, 43% said they skipped meals, 31% took fewer classes, and 69% worked a job during the school year, just to afford textbooks. Most community college students will not make enough at their part-time jobs in a year to cover the costs of just one semester of textbooks.

The reality that students face is, these sacrifices are necessary, college degrees have never been more valuable. Even while the financial burden is increasing, graduates are struggling to find jobs in their field, and experienced workers are being forced to take jobs they are overqualified and underpaid for, the lifetime value of a college degree is still rising. Those taking on the hardships have to believe that the sacrifices will eventually pay off. Yet, the financial burden does not have to be so substantial, there are viable ways institutions can lower costs.

One thing is clear – the academic and subsequent success of a large number of students is at risk and has been for some time. Future generations are losing out on the next leaders in medicine, social sciences, business, education, technology, and more. Colleges and universities have an obligation to provide their students with the tools they’ll need to succeed now and in the future. This includes materials they’ll use at prices they can afford.

To learn more about how you can address textbook affordability and help your students succeed, contact us for more information.

Kelly is the newest Marketing Manager to join the Akademos team and has worked in content marketing, creative direction, and marketing communications across various industries since 2004.